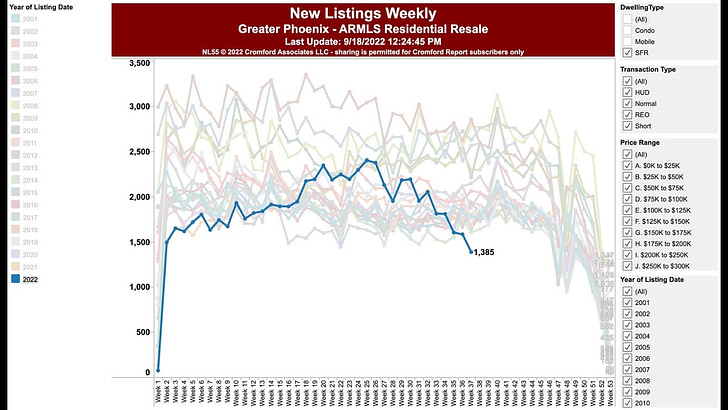

Number of Single-Family Houses Hitting the Phoenix MLS

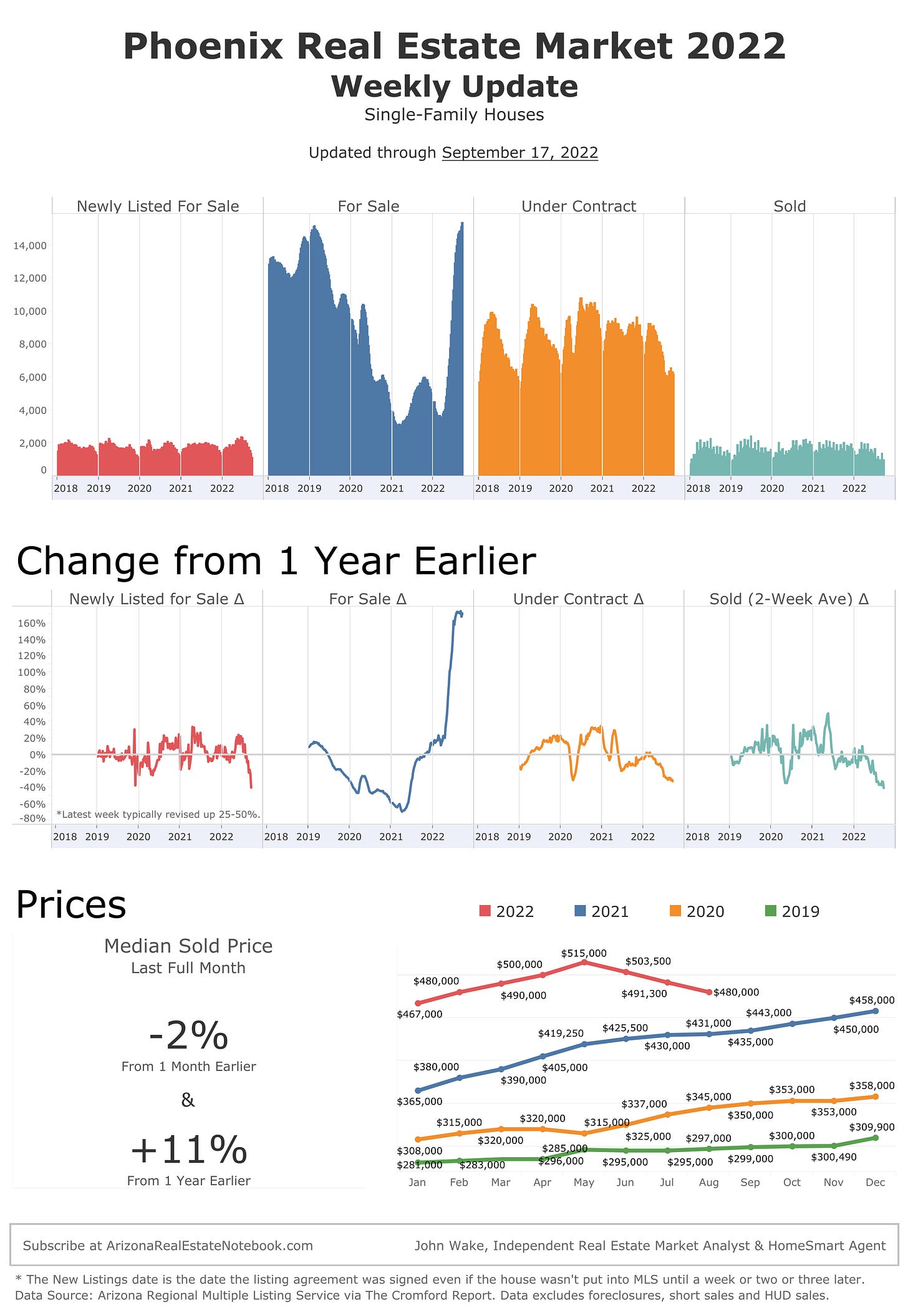

Symmetrical Price Changes

Top Tweets of the Week

Read the whole thing.

"In August last year, Wall Street accounted for 1,757 home purchases in the $250,000 to $500,000 price range. This year, their combined purchases are 601 homes, a decline of 66%. For the graph below, we define “Wall Street” as iB..."

armls.com/docs/2022-Augu…

"

Economist Elliott Pollack told azcentral.com that “this is the worst housing supply/demand imbalance I’ve ever seen. We’re at the precipice of a very serious problem.”

"

He tends to lean bullish which makes his quote even more scary.

WOW!

"Inflation soared to 13% in Phoenix last month, a record for any US city in data going back 20 years..."

"Shelter costs in metropolitan Phoenix climbed 19% in August from the previous year,

compared with a 6.2% gain nationwide."

One HUGE difference between 2005 and 2022.

July 1 to Sept 13

Single-family houses

Newly listed for sale in Phoenix MLS

2005 = 27,147

2022 = 19,219

Why?

Mortgage rate lock-in lowers move-up sellers?

Skyrocketed rents lower investor sales?

Vacation rental shooting adds fuel to Airbnb opposition

A boom in short-term rentals has resulted in hundreds of nuisance calls to police and concerns about Scottsdale's depleted housing supply.

Also

Phoenix’s Apartment Market is Cooling Off Fast

Click on the graphs to go to the full-size, interactive version.

Notice how very small changes in New Listings and Solds eventually cause HUGE changes in the number of houses For Sale and house Prices (see graph above).

This information can vary a lot in different parts of metro Phoenix. Your real estate agent can find the data for your specific city or zip code at The Cromford Report.

Phoenix Weekly Market Graph (only)

17

Your latest changes have been saved.

Version history

Settings

Regarding the drop in new listings, I'm assuming owners don't want to trade their current low interest rate mortgages for new ones with higher interest rates. I would have thought the ibuyers/institutional investors would have dumped more of their inventory into the market by now though given the dropping prices. I'm not a Realtor so I don't have access to that deep data.

Thanks for the posts, John. Good stuff!