A surprising $18,600 fall in 1 month in the median single-family home sold price in the Phoenix area MLS from $495,000 in March to $476,392 in April.

April is usually one of the strongest months for home price gains.

But it is only one month. Prices might rebound some in May.

But the outlook isn’t good for prices when the supply of homes for sale is the highest since 2011.

The supply of homes for sale is;

~ 50% higher than last year at this time, and

~ 500% higher than in 2021, at this time,

But only half as many homes are for sale as in 2007 and 2008.

I Got a Quick Clip on AZFamily TV

And I Got a LONG Podcast Interview

The Real Reason Home Prices Skyrocketed

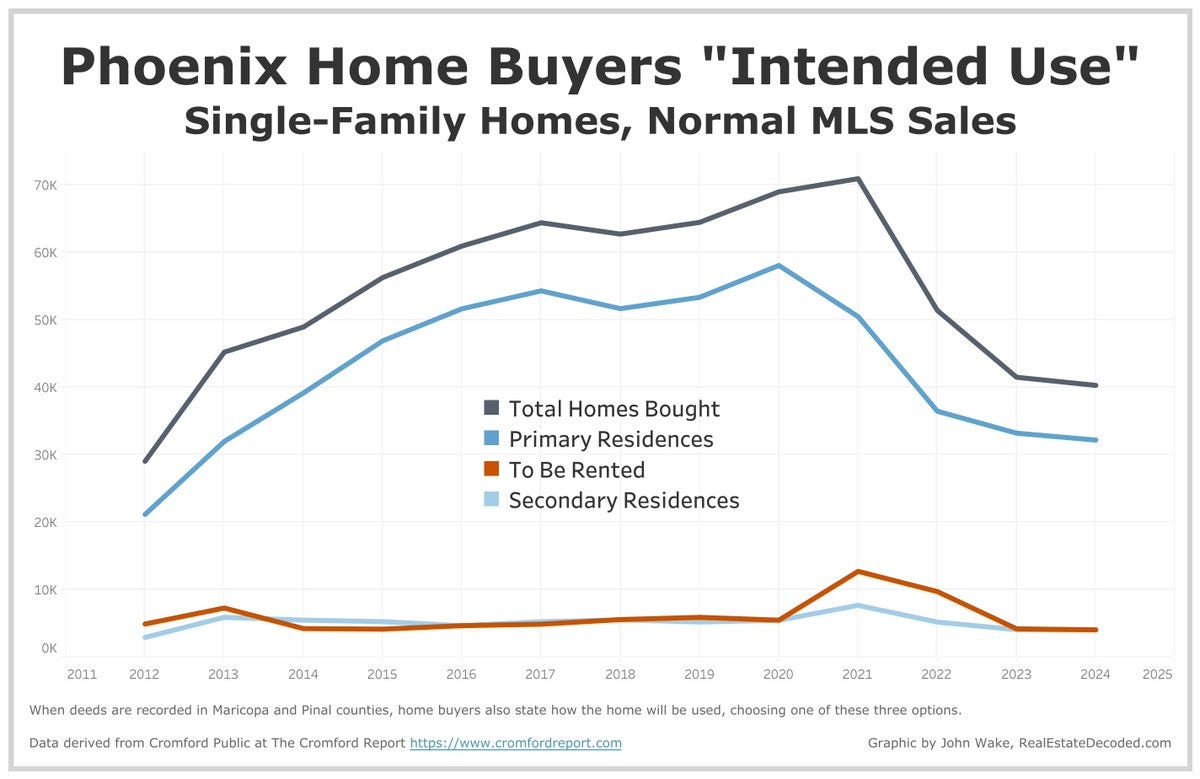

The huge spike in Phoenix home prices in 2021 ($75,000) wasn't caused by live-in home buyers.

It was caused by a spike in investor purchases.

Live-in home buyers actually bought FEWER homes in 2021 than pre-Covid 2019.

Interactive version at https://public.tableau.com/app/profile/john.wake/viz/RedfinInvestorPurchases/Dashboard1.

A different dataset comes to the same conclusion.

Primary-home buyers did NOT cause house prices to skyrocket in 2021 in Phoenix. Investor buyers did.

Investors bought 6,800 more homes in 2021 than in pre-Covid 2019. Investor purchases more than doubled.

Primary-home buyers bought 2,900 FEWER homes than in 2019.

Interactive version at https://public.tableau.com/app/profile/john.wake/viz/IntendedUse2024/Dashboard1.

Scottsdale Rents Fell a Lot Last Month!

According to Apartment List, "Scottsdale rents went down 0.9% in the past month, compared to the national rate of 0.5%. Among the nation's 100 largest cities, this ranks #99."

https://www.apartmentlist.com/az/scottsdale#rent-report

Click on the graphs to go to the full-size, interactive versions.

Notice how very small changes in New Listings and Solds eventually cause HUGE changes in the number of houses For Sale and house Prices (see graph above).

This information can vary a lot in different parts of metro Phoenix. Your real estate agent can find the data for your specific city or zip code at The Cromford Report.

Great analysis as always!