Being new grandparents, when Liz and I were taking a walk around the park this morning I asked a couple how old their little one was (13 months?) and chatted a bit and then the dad asked if I was John Wake! Turns out he’s a fan of this newsletter and blog! That was fun!

Phoenix Real Estate Market - Update

Active Listing Up 20% in 2 Weeks!

Looks like a break in trend 2 weeks ago in Active Listings of single-family detached homes for sale. From the 2nd to the 4th week of April, Active Listings increased 20%. In a normal year, they would be trending down slightly at this time of year.

We're not seeing an increase in new listings hitting the market but a decrease in listings going under contract. It's only 2 weeks so it may be an anomaly but likely it reflects the sharply higher mortgage rates starting to reduce demand.

More Supply on the Way

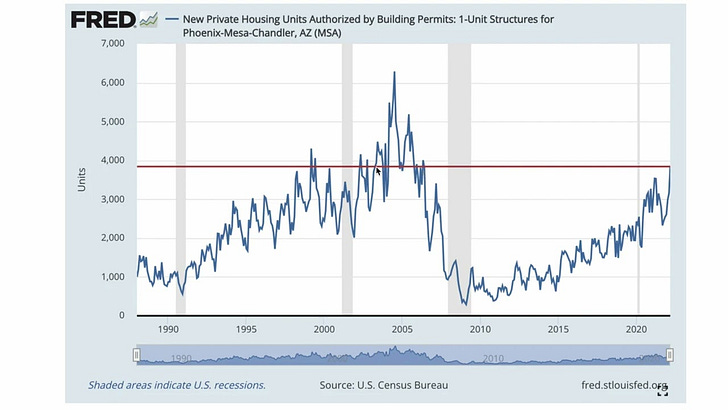

Phoenix building permits for single-family houses in March were the highest since 2006 and 66% higher than 2 years ago March.

Phoenix Factoid

In March 2009, 10,114 Notices of Trustee Sale were sent out in Maricopa County. That's the first step in the foreclosure process here. In March 2022, 413 were sent out.

The big question is, “What will investors do?”

They’re driving the market now, and my scenario assumes they start to cool on single-family houses.

Click on the graphs to go to the full-size, interactive version.

This information can vary a lot in different parts of metro Phoenix. Your real estate agent can find the data for your specific city or zip code at The Cromford Report.

I always appreciate your analysis. I'm an investor and I track investor sentiment within my US networks. A couple more important stats to follow include:

Immigration - it's off the charts and people like to live indoors! This will continue to put huge pressure on the lower end of the market.

Vacancy rates - lowest numbers in 40 years! This motivates investors.

Rental rates - higher by 20-30% in 18 months. This motivates investors and renters to buy.

ARMs - adjustable products are increasing in popularity again which will keep payments "affordable."