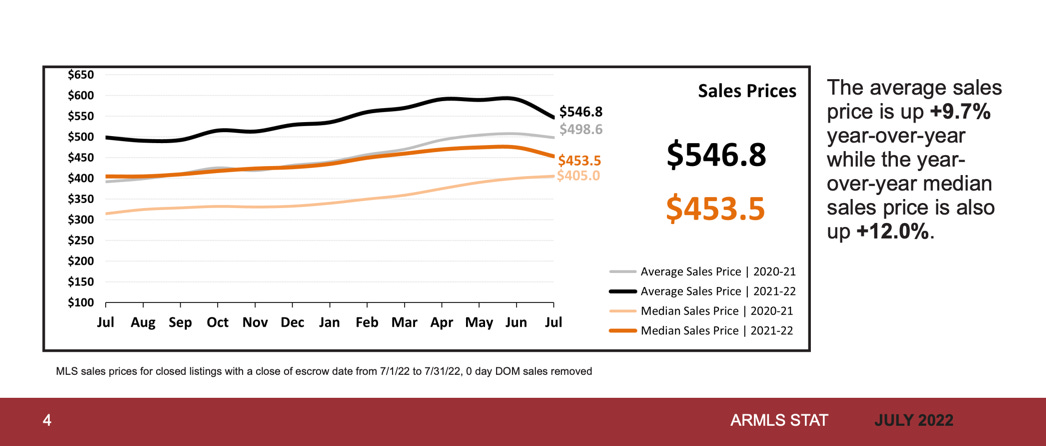

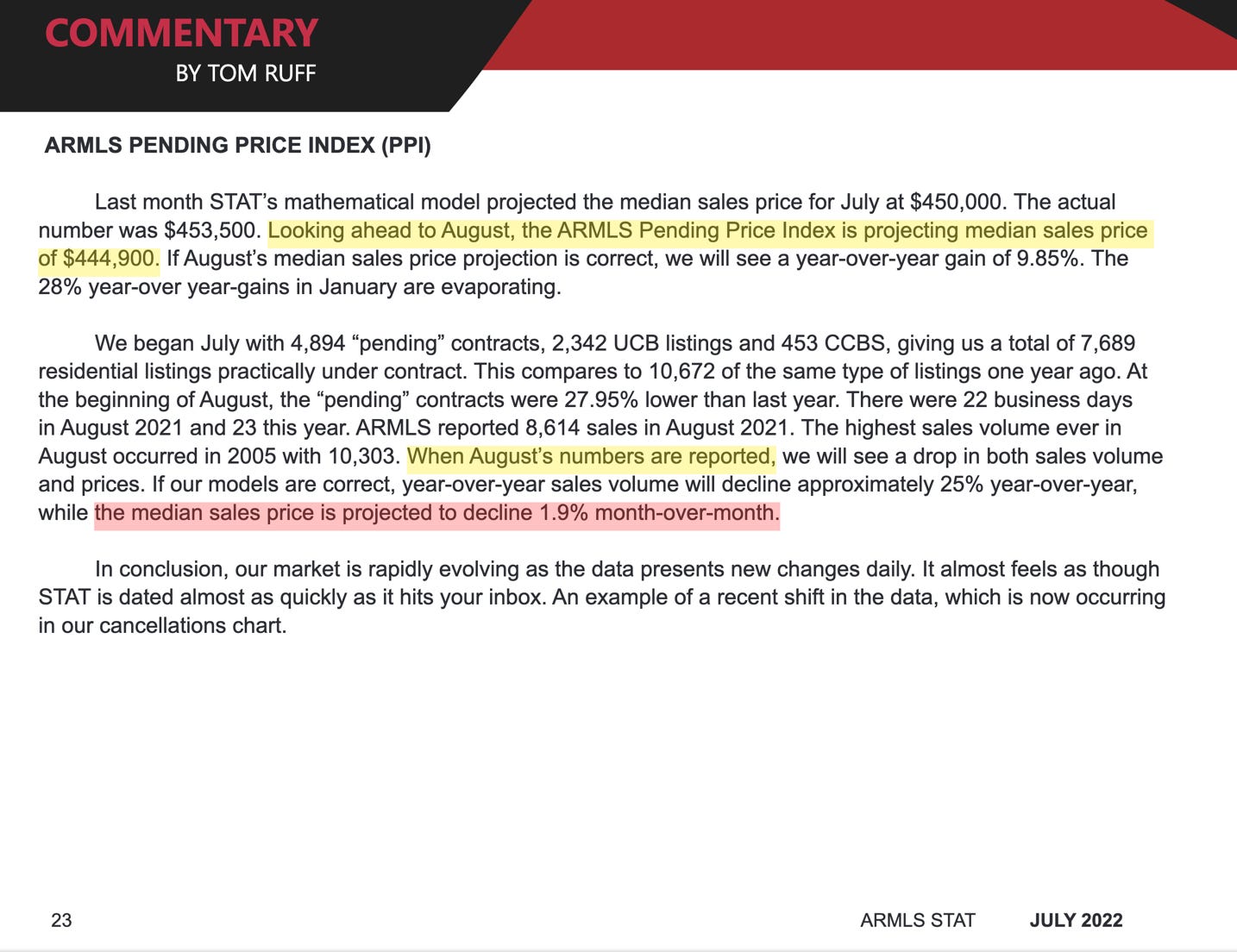

Phoenix Median Sold Price Fell 4.5% from June to July and is Forecast to Fall 1.9% in August

Check Out the Latest from the Brilliant Tom Ruff at The Information Market

The Cromford Report

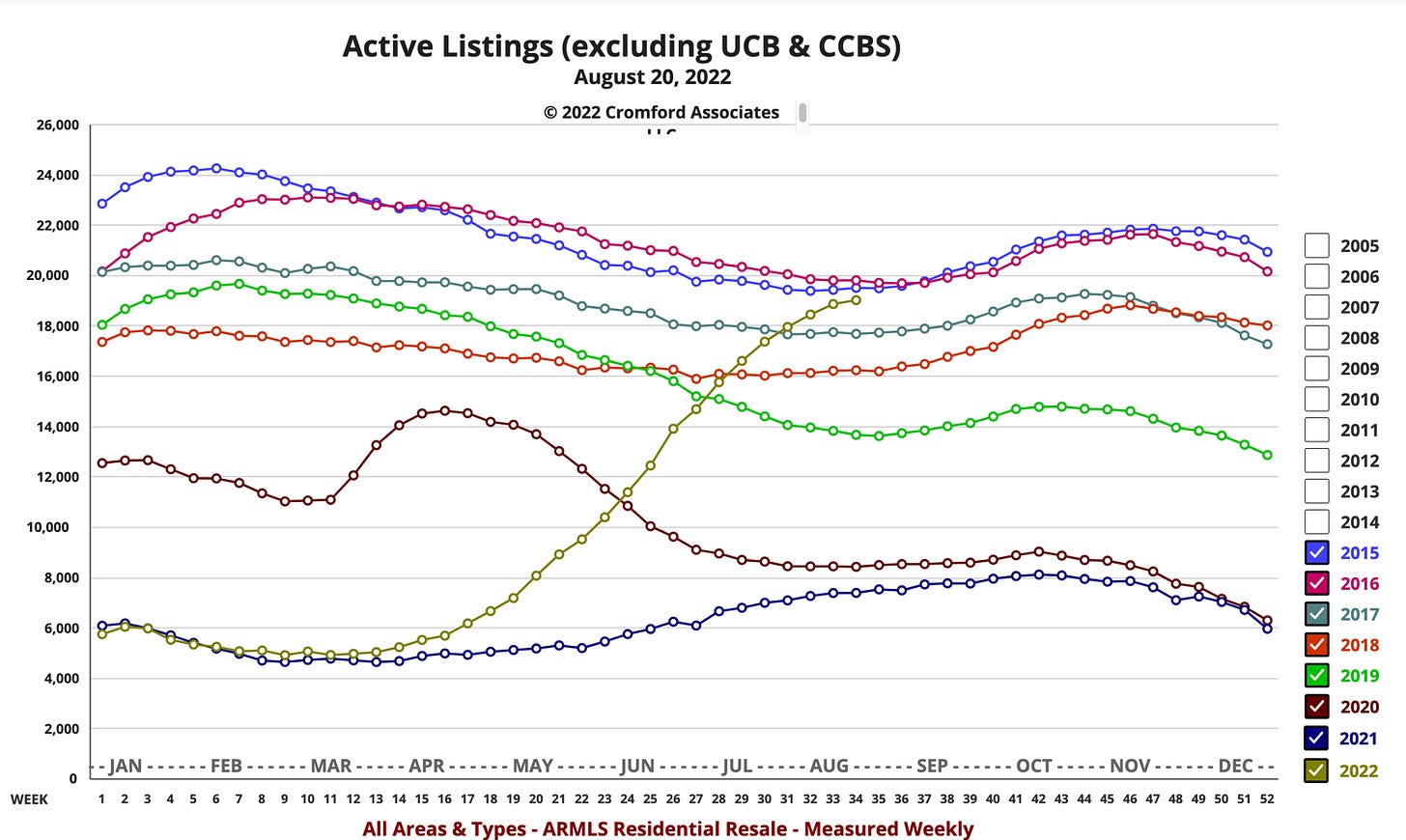

Looking at all residential homes for sale in the metro Phoenix MLS, in a week or two, the number of houses for sale should match levels for the same week in 2015.

The number of single-family, non-distressed houses for sale in the Phoenix MLS is leveling off but is 2.7 times the same week last year.

Last time, the number of houses listed for sale in the Phoenix MLS skyrocketed BEFORE the Great Recession started. This time won’t be like last time but this shows the worst-case scenario.

Twitter

These 2 Tweets on the impact of buyers and sellers having more and more information sounds a lot like Tom Ruff’s comment above about social media.

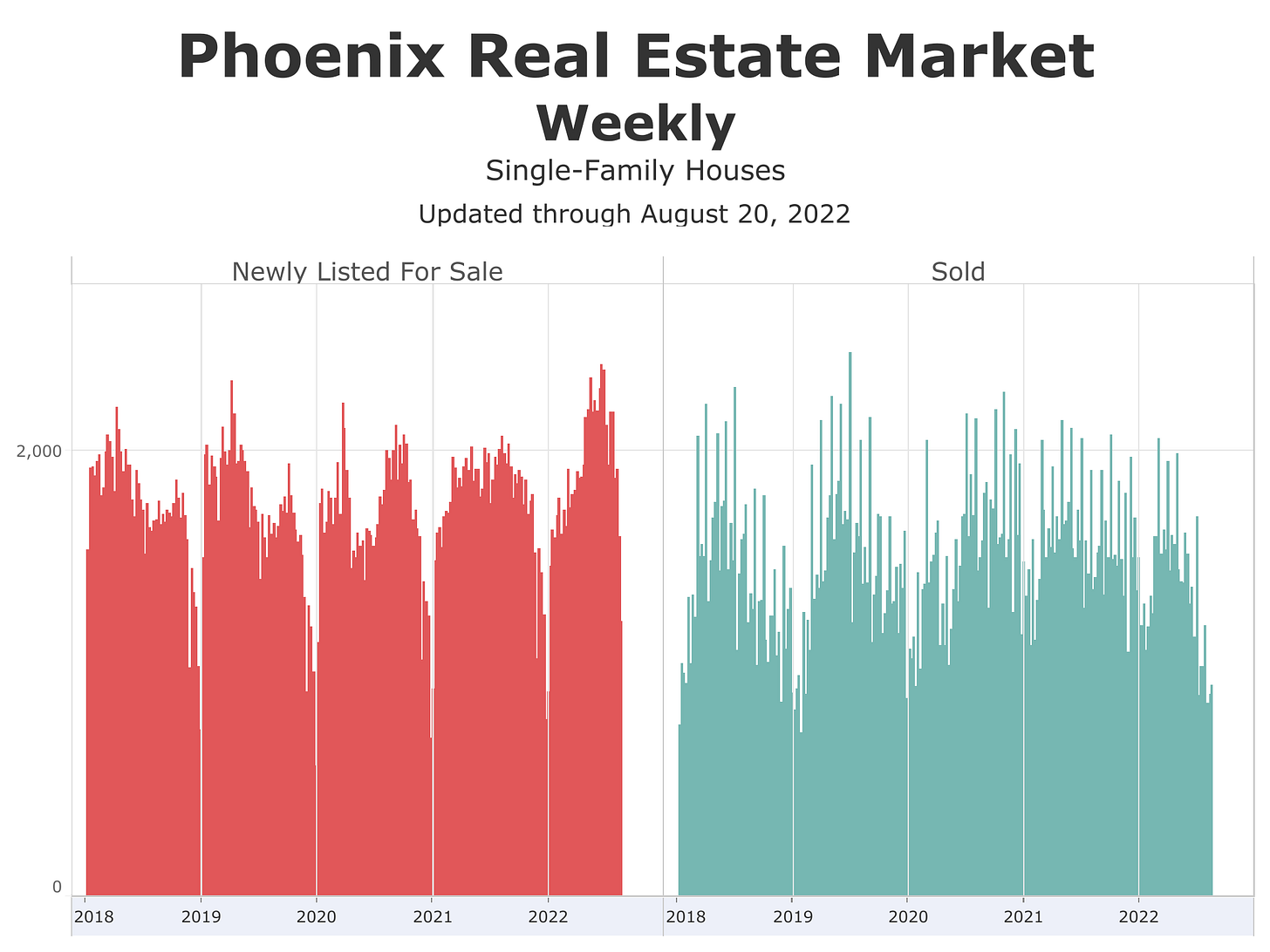

Click on the graphs to go to the full-size, interactive version.

Notice how very small changes in New Listings and Solds eventually cause HUGE changes in the number of houses For Sale and house Prices (see graph above).

This information can vary a lot in different parts of metro Phoenix. Your real estate agent can find the data for your specific city or zip code at The Cromford Report.