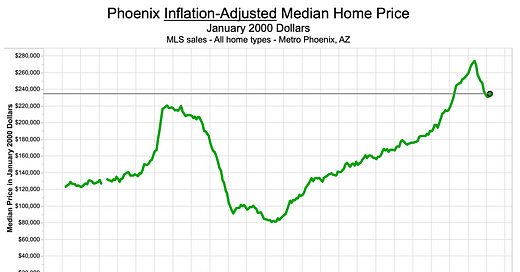

Phoenix inflation-adjusted sold house prices are still above the 2005-2006 peak.

High Season Winding Down

The Cromford Report is estimating the average sold price per square foot will increase 0.8% from mid-April to mid-May. That’s a big increase for one month but it’s quite a slowdown in upward momentum from the 2.4% increase from mid-March to mid-April. The increase from mid-February to mid-March was 1.9%.

It’s looking to me like sold house prices will peak in May this year just like last year.

Chris Joye

If you’re looking for a bear case, there’s none “better” than this one from Australian Chris Joye.

He says about the surprising bounce in house prices since February, “It looks like a dead cat bounce.”

He’s forecasting interest rates will stay higher for longer than the market expects and that will change everything.

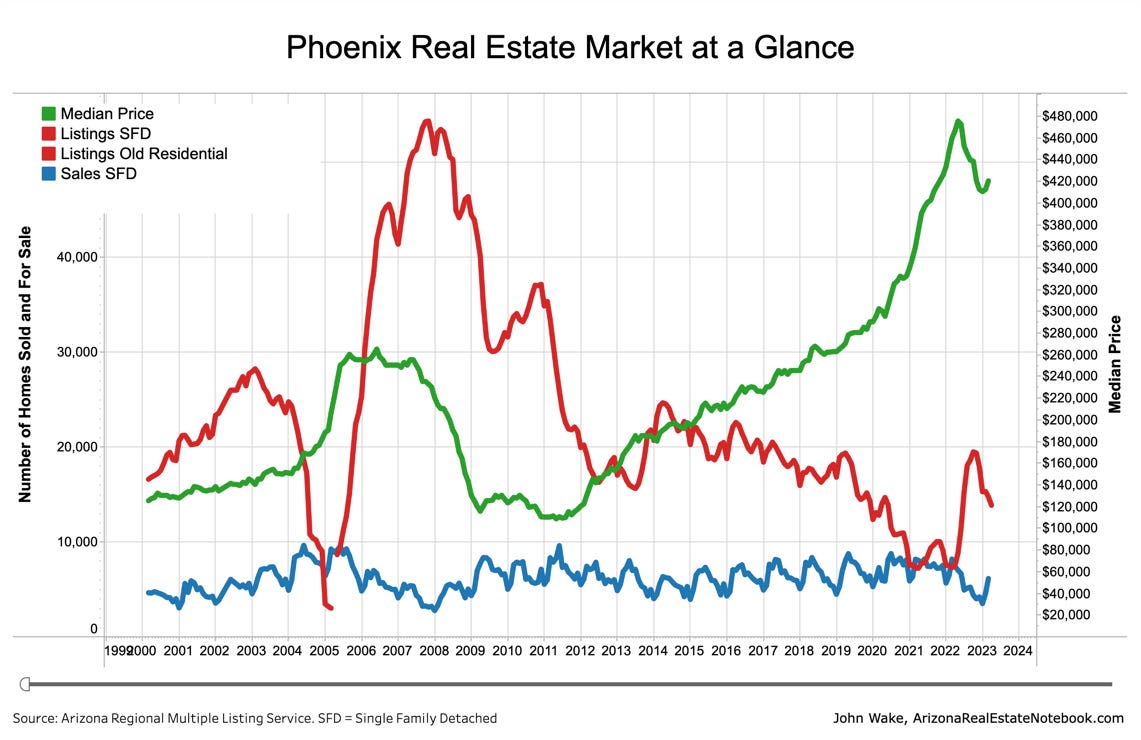

Active Listings Continue to Fall

Active single-family listings in the metro Phoenix MLS are now below the level of 2020 for the same week. That's bullish for house prices and the median single-family sold price was indeed up in February and March, and very likely will be in April.

Bankruptcy Filings Up

"March US corporate bankruptcy filings push Q1 total to highest since 2010"

Click on the graphs to go to the full-size, interactive version.

Notice how very small changes in New Listings and Solds eventually cause HUGE changes in the number of houses For Sale and house Prices (see graph above).

This information can vary a lot in different parts of metro Phoenix. Your real estate agent can find the data for your specific city or zip code at The Cromford Report.

So many abnormal factors are in play. My belief - if you want to know what's going to happen with home prices watch what happens to employment, which is not easy. How many remote workers who came here to escape strict COVID restrictions will remain here? If the SVB failure continues to roil the tech sector employment in California, will tech employers demand that some/all workers report to an office if they think they can make it stick?

The TSC chip plants will go forward unless China somehow destroys the Taiwanese economy through war - but that threat is why TSC is moving its production here.

Speaking of wars - if for any reason Ukraine finally collapses as a nation four times larger in population continues to lean on them, food prices will go even higher. Toss on top of that brushfire the risk that despite huge snowfall this year, the Colorado River forces agricultural activities to cut back. Enormous population loss would result. Those workers will return to other countries in many cases. And while they occupy the cheapest of housing in remote locations, the sucking sound at the fringe impacts everyone near them.

Carvana and Lucid are dumping workforce. Electric vehicle startups will struggle as the automotive supply chain completes its restoration (almost there), and as extreme COVID Car pricing collapses.

And construction workforce will be slashed the moment that an oversupply is sensed - especially when developers are eating higher construction loan costs.

It's a weird world - nothing in my fifty years since I was a fresh faced Econ student comes close to matching this. We could see the Phoenix housing market collapse on a greater scale than anything that happened in 2005 forward.

Or the opposite.

I defy anyone to assess all of those factors, weigh them appropriately and predict the market successfully due to anything other than luck.